Regulators are expecting financial institutions to become truly data-driven. New credit losses accounting standards such as IFRS 9 and CECL require banks, insurers and other institutions who hold credit portfolios to make significant changes to their loss forecasting methods.

SEC filers must have adopted CECL by 2020 with other public business entities following closely behind. The business impacts of CECL will vary depending on each organisation’s asset portfolios, market and other conditions. However, most organisations expect to see an increase in reserves.

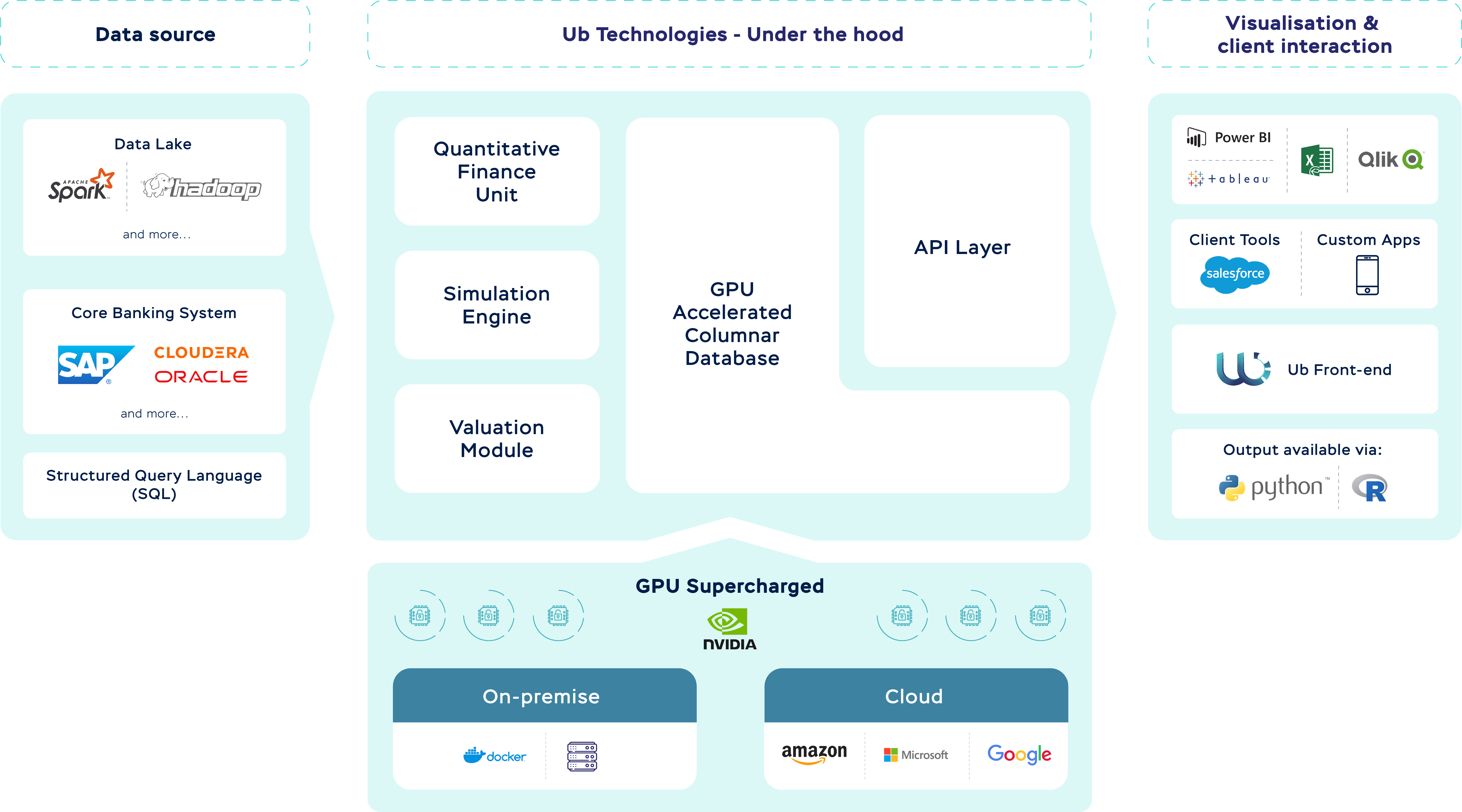

Our platform helps you to evaluate asset quality of your portfolios by exposing them to different market environments and scenarios. The unprecedented runtimes allow for multiple iterations, minimising the risk of missing regulatory deadlines because of data problems - via early identification - or human error.

Want to schedule a demo? Or get help in finding the right plan for your regulatory roadmap? Please contact one of our experts.

There is a massive amount of data available inside and outside your organisation, and it is growing explosively. Consequently, there is an urgent need for data access and better insights for purposes such as: credit risk management, asset-liability management, P&L and capital planning.

Our platform leverages available compute capacity and enables you to monitor and analyse portfolio risk and reward attributes. Not only and portfolio level, but also at individual counterparty or asset level. The platform also allows you to forecast with horizons from one day to five years. Get better insights in fair values, cashflows and the risk and return measures relevant to you such as Value at Risk, Expected Tail Losses and ROIC. Benchmark portfolios and identify outliers. Improve your understanding of the impact of management decisions on new origination, portfolio compositions and overall performance.

Want to schedule a demo? Or get help in finding the right plan to improve your business insights? Please contact one of our experts.

With earnings models under pressure, financial institutions are looking for new revenue streams and earnings growth. We revolutionise the way we think about portfolio optimisation by allowing thousands of portfolios to be analysed a day. This helps you to better understand the true drivers of performance and to build your business cases.

Acquire granular risk/reward insights including measurement over time at individual asset and portfolio level. Apply Monte Carlo tree search methodologies to optimise the composition of your portfolios, taking into account diversification benefits and market circumstances. Optimise your economic value for the amount of risk taken.

Our platform enables you to get the most out of your credit and risk expertise. It also helps to improve your strategic asset allocation and business planning process.

Want to schedule a demo? Or get help in finding the right plan to unlock growth? Please contact one of our experts.